The benefits of having five different generations in the workforce definitely outweigh the cons. But it has shown us that benefits communication needs to change to better resonate with our age-diverse population. And as open enrollment quickly approaches, HR and benefits pros face a whole new challenge: how can we create an inclusive benefits experience for every employee, no matter their stage of life?

That task is no easy walk in the woods, which is why we caught up with a few experts at Camp Engage who have successfully supported their workforces at every step of their careers. Here are their best tips for driving benefits engagement with every generation during this year’s open enrollment.

Meet the Speakers

Josh Hansen

Total Compensation & Training Manager, City of Bloomington

Anne Burkett

National Practice Leader, Workforce Solutions, USI Insurance Services

Christine Pabst

Director of Employee Benefits, American Electric Power

Alex Muehl

Moderator

SVP of Customer Operations, Jellyvision

How do you define the different generations in the workplace?

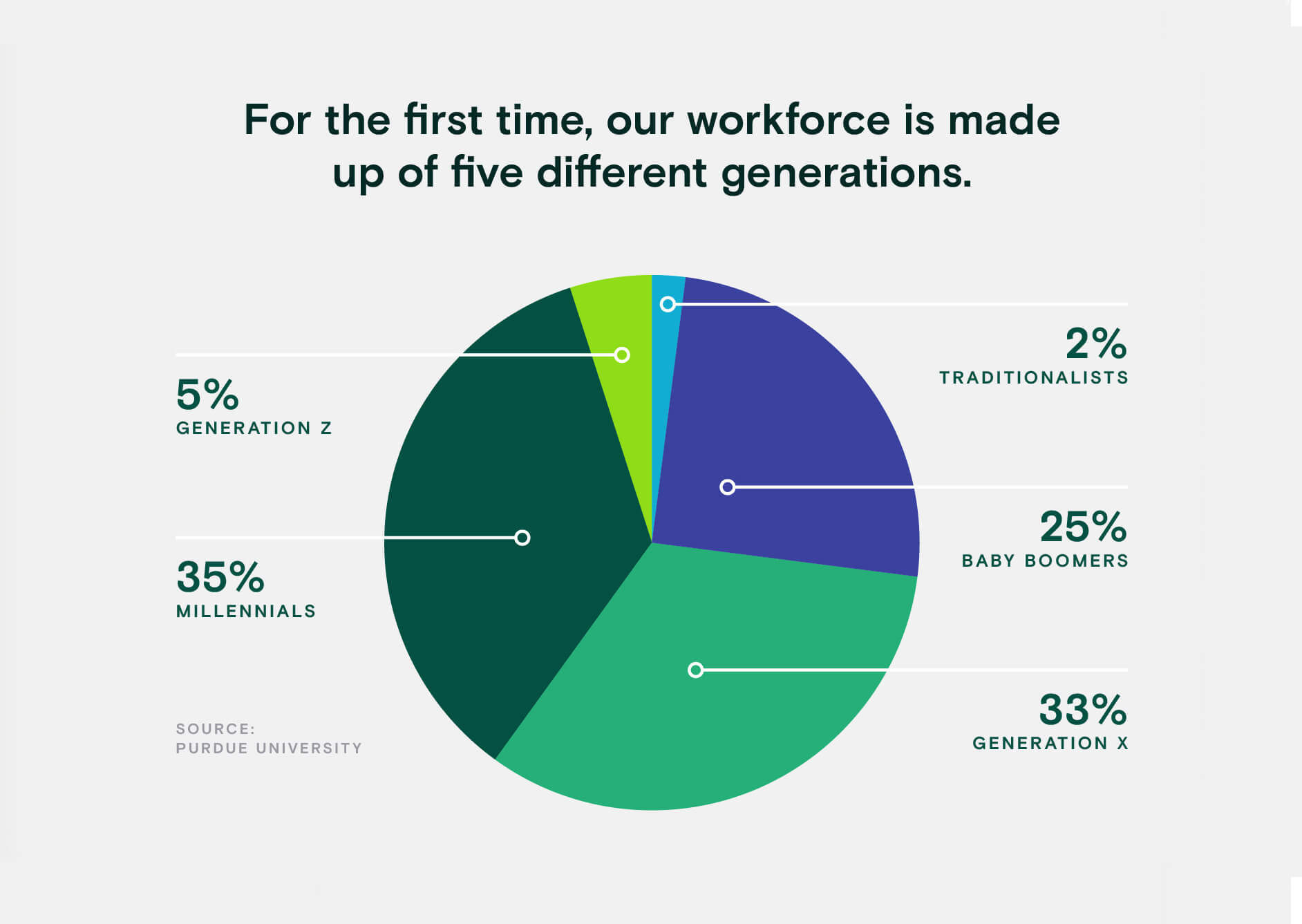

The first step in meeting the needs of a multi-generational workforce during open enrollment is to understand the unique populations within your organization. While Baby Boomers are living longer and working longer, a new generation of young employees is emerging, too:

But looking at the generational breakdown on a national level isn’t enough. Our experts shared that it’s also important to look at your organization on a micro level:

As you start planning for open enrollment, consider your audiences. What does your unique employee population look like, and what are their goals and priorities? How can you break up your staff into different segments to further personalize your messaging? Answering those questions will help you determine the most important benefits and other resources to highlight this year.

How do you tailor the employee benefits experience to each population?

Now that you have a lay of the land, it’s time to think about the actual how: what can HR pros do to connect the right employees with the right benefits at the right time?

Our experts shared that the work starts long before open enrollment begins. From getting to know employees’ needs better to expanding benefits packages, here’s what they had to say:

It may be too late to add any more variety to your benefits package this year—but the good news is that many organizations have already expanded their total rewards package to include a wider array of resources, meeting the unique needs of their workforce.

Now, your job is to find out which of your existing benefits each employee group is most interested in so you can better target your open enrollment messaging. That can take the form of a survey, or you might review your usage and claims data from previous years to make some assumptions.

How can we best engage Gen Z around their benefits?

While Gen Z may just be entering the workforce now, they’re a growing population that can’t be ignored.

So what’s important to this youngest employee segment? What are they most likely interested in learning about this open enrollment, and how do they want to learn about their benefits?

Our experts shared that Gen Z is thinking a lot more holistically about their benefits package than their older counterparts. It’s not just about health insurance anymore:

For your youngest employees, this open enrollment will be all about connecting folks with the resources they need to care for their mind, body, and wallet. And for the TikTok generation, it’s going to be a lot harder to earn attention—so quick, snappy, digital communication is best:

ALEX breaks down complicated benefits topics quickly, in a simple, human way — anywhere, on any device.

What about Baby Boomers?

It might be easy to forget about Baby Boomers during open enrollment, who are experienced in choosing their benefits and are close to leaving the workforce. But our panelists revealed that aging employees are more important than we might think, and it’s becoming increasingly important to support our people pre-retirement.

With an average life expectancy of 76.1 years, United States workers aren’t retiring as quickly as they used to. And as birth rates fall, the World Health Organization warns that retirement-age and older adults outnumber children under the age of five. And these aging employees still have a lot to offer.

So as we look ahead to open enrollment, benefits pros should consider this growing population, providing them with the resources they need to transition into retirement comfortably. Because unfortunately, many folks haven’t saved enough to leave the workforce at the traditional age.

What are the best ways to educate pre-retirement employees about their options during open enrollment? Josh shared how they tackle it at the City of Bloomington:

Watch the full conversation between Josh, Christine, and Anne on-demand!

A more inclusive open enrollment for all

Effective communication during open enrollment is crucial for engaging and empowering each generation of the workforce. By understanding the unique characteristics, preferences, and communication styles of every age group, employers can tailor their messages to better resonate with employees—and cater to the diverse needs of their staff.