If your social media feeds have been flooded with headlines about artificial intelligence lately, you’re not alone. It seems like everyone’s buzzing about rapid advances in this new technology, and are debating the pros and cons. Is it the Golden Age of AI? Or should we be concerned about how quickly machine learning has invaded our lives?

Whether you’re an avid ChatGPT user or are approaching AI with trepidation, one thing is clear: artificial intelligence has gotten a lot smarter in recent years, and will have a major impact on just about everything we do—from how we work to how we communicate with our loved ones.

But what about the world of employee benefits? Here at Jellyvision, we’ve been hard at work dreaming up ways to apply the best aspects of AI to our platform, ALEX. We’re already finding ways to improve the benefits experience for you and your employees, just in time for this year’s open enrollment.

Here’s why an AI-driven approach is becoming necessary for HR and benefits pros, and how we’re using predictive analytics to drive stronger connections with employees during open enrollment and beyond.

Now’s the time for a better open enrollment experience…

Benefits pros, you all work incredibly hard to drive engagement with employees during open enrollment. You craft beautiful benefits guides, schedule all-hands presentations, and send countless reminder emails.

And don’t get us wrong—all that work is truly valuable. We’ve come a long way in educating employees about the benefits that are right for them. But unfortunately, we’re still falling short in a lot of ways:

The truth is, choosing the right benefits at open enrollment is just plain complicated. There are countless factors at play, from locking in the right amount of coverage to understanding how much each plan will cost. And it turns out, there’s a disconnect between how much we think our employees know, and how much they actually know:

On top of all that confusion, employees are also craving more personal connections with their HR teams. In recent years, our workforces are reconsidering their relationships with their employers and are demanding that they be treated as people, not just as workers:

And during open enrollment, even the best benefits guide or company intranet can’t cater to those needs. When it comes to their physical, mental, and financial health, no employee is the same, and they need personalized guidance to get the most cost-effective and comprehensive care:

But that’s a tall order—that traditional benefits communication methods simply can’t meet. So how can we address these gaps in healthcare understanding, help employees make better financial decisions, and drive stronger relationships with our workforces during open enrollment?

…And predictive analytics is the answer

That’s where new technology like predictive analytics comes in. Here at Jellyvision, we’re leveraging the latest technology to strengthen the benefits experience during open enrollment, and solve all of the problems we’ve traditionally faced around helping employees make the best choices.

But before we get into the how, you might be thinking, “I’m a benefits expert, not a data scientist…how am I supposed to know what predictive analytics is?”

So let’s level-set with a basic definition:

Predictive analytics uses historical data and machine learning to identify how likely it is that a future event will happen. By analyzing historical information, predictive analytics algorithms can spot patterns and trends, giving end users a better idea of how a given scenario will play out.

How can we apply that concept to open enrollment? Let’s take a look at an example.

We all have to choose a health plan during open enrollment. And on the surface, it looks like a really simple decision, right? We only have three or four plan options at most, and if we’ve been an employee for a long time, it’s tempting to just choose the plan you enrolled in last year.

Well…not so fast. It turns out, the benefits selection process is really, really hard.

What’s the reason for all these missteps? When we break it down, there’s a lot of work to do to understand the complexities of each health plan option, and there are lots of questions employees need to answer to break down their choices.

First, let’s remember that employees buy health insurance to help pay for their healthcare bills. So if they want to know which health plan to pick, it would be really useful to understand how much healthcare they’ll actually need.

The problem is, this is really hard for any human to anticipate what they’ll need for the year. Sure, employees may have some routine expenses, like prescriptions or therapy that they know they’ll need on a regular basis. But outside of those types of expenses, healthcare usage is really hard to predict.

Second, even if employees could predict what their healthcare needs would be, they’d also need to know how much it will all cost. Despite new legislation intended to increase transparency, healthcare pricing is notoriously all over the place.

Finally, even if employees could figure out what healthcare they need and what it would cost, they’d also need to understand how each benefit actually works, so that they can accurately use and pay for the healthcare they’ve chosen.

All in all, there’s a mountain of knowledge employees need in order to select the best benefits. It’s too much for any one human to figure out, especially when they also have a job and a personal life to worry about.

But these kinds of problems are a snap for predictive analytics to solve. Artificial intelligence is really good at processing tons of data, crunching the numbers, and drawing simple insights from complex situations.

Let’s take a look at how ALEX is making it happen.

Learn how ALEX and predictive analytics are a match made in heaven:

ALEX uses hard math to help employees make easier choices

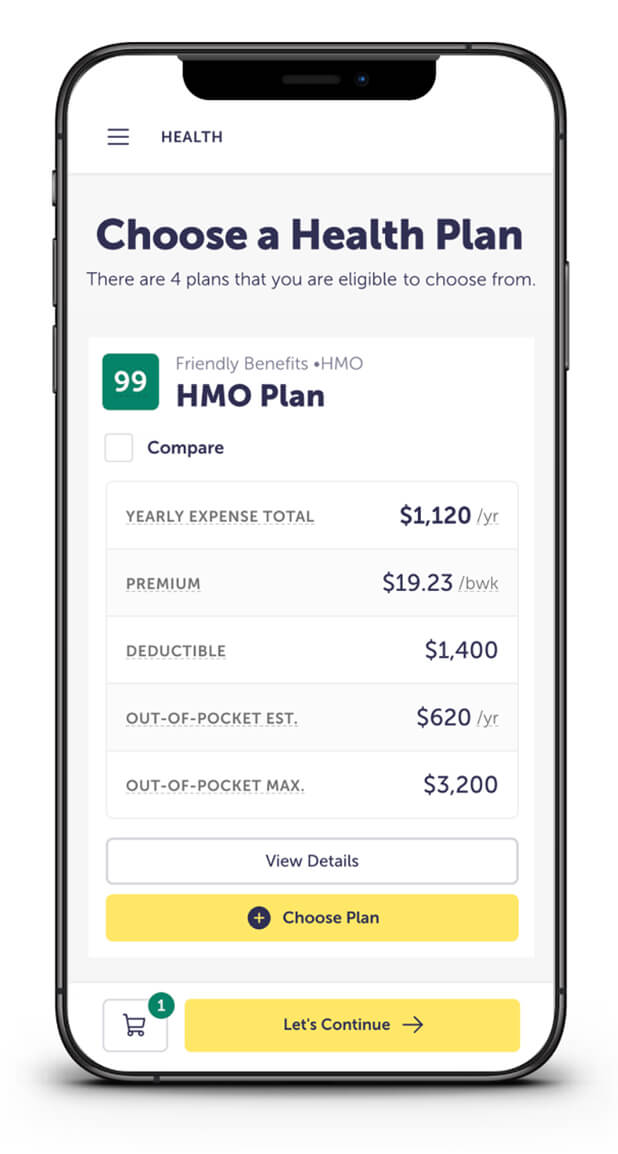

By tapping into the power of predictive analytics, ALEX is making it easier for employees to consider every factor, from cost to coverage, and guides them towards smarter healthcare choices based on their own preferences and data from people just like them.

Here’s how we’re doing it:

- ALEX analyzes anonymous claims data from people nationwide to see how they’ve used healthcare over the years.

- A one-on-one conversation happens between ALEX and an employee to understand their unique health status, personal preferences, and risk tolerance.

- With the help of machine learning, ALEX matches these personal variables against other groups of People Like You who share similar healthcare needs and risk factors.

- ALEX analyzes the data points from People Like You to predict the employee’s future healthcare use and costs, all based on the actual experiences of similar people.

- ALEX then uses behavioral economics to account for an employee’s financial risk and personal preferences.

- Finally, ALEX generates a suggestion, which is a personalized recommendation that considers cost, risk, and individual preferences to help employees find the best value.

Through the power of predictive analytics, ALEX gives each employee a truly personalized benefits recommendation plan that’s unique to their needs, risk tolerance, and lifestyle. No other platform or benefits pro can offer such accurate guidance, all while properly educating and engaging employees along the way.

ALEX uses open enrollment as an opportunity to lay the foundation for real behavior change, setting employees up for a lifetime of healthier, more financially sound choices—this year, and throughout employees’ careers. That means a more engaged workforce, and a better return on your benefits investment.

Now that’s open enrollment done better.