Hot topic alert: Medicare is on our minds more than ever here at Jellyvision. In our conversations with customers, discussions with industry experts, and personal experiences with our own families, better Medicare education is rising to the surface as one of the most pressing needs of the modern era.

Why? While we understand the value of the aging workforce more than ever, we’re still leaving Medicare-eligible folks high and dry. Too many options, confusing jargon, misinformation, and one-size-fits-all solutions make Medicare overwhelming and difficult to navigate.

Let’s take a deeper dive into why our current approach to Medicare isn’t working, and how HR and benefits pros like you can build a better future for employees young and old.

Medicare-eligible folks are struggling

Medicare has never been easy. But with an increase in plan options, changing regulations, and a slew of third-party vendors offering conflicting information, things have only become more complicated for eligible folks.

And as employees live and work longer, they’re faced with an even more challenging question: how does Medicare fit in with other employer-sponsored benefits? And how will Medicare work once employees do decide to retire?

All that confusion comes at a hefty cost. As employees make important financial decisions about their retirement, their biggest risk isn’t how much they have saved in their 401(k)s, or whether they made good personal investments throughout their life—it’s actually Medicare. One wrong turn could mean thousands in unexpected healthcare expenses, and Medicare beneficiaries aren’t confident that they’re making the right decisions.

Our current solutions aren’t working

Why is the Medicare maze so difficult to navigate for beneficiaries? Well, we haven’t made it very easy for folks to learn about their options and choose the best plans for their health and wallet.

Misinformation runs rampant

To start, the system itself is broken. Unfortunately, Medicare-eligible folks are bombarded with a slew of sometimes conflicting and misguided information about the plans they should choose. And some third-party marketing organizations are especially guilty of pushing Medicare guidance on unknowing consumers—and more often than not, they’re trying to sell a certain plan with no regard for the customer’s real best interests.

That’s an especially alarming truth for HR and benefits pros. It’s hard enough to keep up with changing regulations and educate employees on the most up-to-date resources without having to worry about folks receiving misinformation from sources we can’t control.

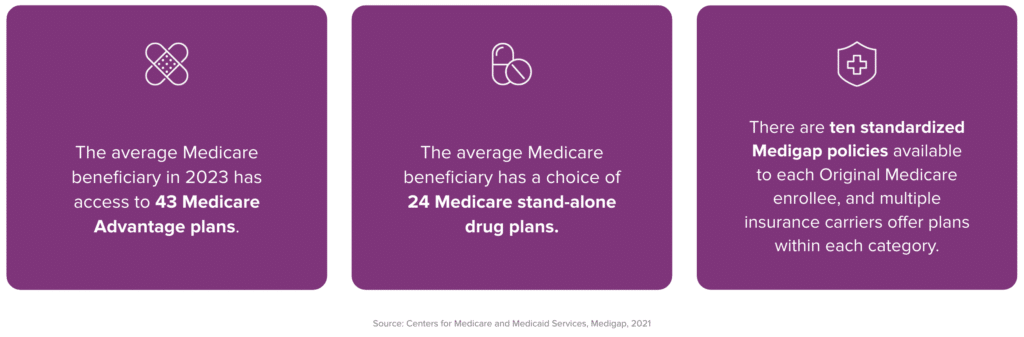

Too many options, not enough personalization

Medicare users have access to dozens of plans, but typically receive very little guidance about which ones are the best for them personally. Every person uses their healthcare differently and has a unique learning style. Medicare-eligible folks might range from a younger person who qualifies for coverage due to a disability to a 70-year-old who’s heading to Florida for retirement. That means we need to get a lot more targeted in how we educate folks about their options.

We also haven’t traditionally offered much support for aging employees who are still in the workplace. As more employees push off retirement, we still haven’t built systems to support an older workforce, and Medicare education is a big part of that. We are starting to see some positive trends from leading employers like Best Buy, who are stepping up to provide more support. But it’s still too labor-intensive to scale:

The answer: better Medicare education for all

So how do we finally reach Medicare beneficiaries with the information they need to make smarter healthcare decisions? It’s time for a communication strategy overhaul. Here’s how:

Start talking earlier

If you’re waiting until beneficiaries become eligible for Medicare to have a first conversation with them, it’s already too late. Just like retirement savings, it’s important to prepare employees for aging throughout their careers, and a little upfront education can help them make smarter decisions as they prepare to leave the workforce.

So be sure to mention Medicare throughout the employee lifecycle, from early-career folks all the way up to near-retirement populations.

It’s a family affair

Medicare decision-making doesn’t happen in a vacuum. Most folks are conferring with their spouses and children before choosing a plan. So it’s important to consider family members in your communication plans as well and offer educational materials to younger employees who may be caring for elderly parents.

That’s where more modern channels like text, video, and online platforms can come in handy, helping you reach younger generations who still may need Medicare education.

Take a multi-channel approach

One-size-fits-all doesn’t work when it comes to clothes, so it won’t work when it comes to Medicare education, either. Folks have different communication preferences, and want to learn about their healthcare options where they’re already spending their time. That might be text, email, an in-person conversation, a video series, or a one-pager.

And because Medicare’s so complicated, they’re probably going to need you to repeat a few times. One big push isn’t going to be enough to get your message across, so don’t forget to build in frequent reminders.

Here’s how to build a year-round, multi-channel benefits communication strategy.

Lean on technology

Lastly, don’t sleep on the power of technology. Today’s seniors are way more tech-savvy than we give them credit for, and they’re ready to learn about their healthcare options online.

And it’s not just about a benefits portal or company intranet, either. Now, tools like ALEX Medicare make it easy to scale your communication strategy in a personalized, accessible way. ALEX offers current and prospective Medicare beneficiaries (and their loved ones!) unbiased education from a trusted resource. Through interactive conversations and learn-at-your-pace modules, ALEX helps folks learn about Medicare eligibility, enrollment, coverage options, costs, and how Medicare works with employer-sponsored benefits.

A new day for Medicare

There’s never been a more pressing time for HR pros and benefits advisors to rethink their approach to Medicare communication. By addressing current challenges and adopting more proactive and personalized strategies, organizations can empower employees to make informed decisions about their healthcare coverage as they transition into retirement. By prioritizing personalization, simplicity, accessibility, and ongoing education, organizations can ensure that employees have the knowledge and resources they need to navigate the complexities of Medicare with confidence and clarity.