Voluntary and supplemental benefits used to be an afterthought—a nice-to-have but not essential. And frankly, that’s no longer the case. HR and benefits professionals have recognized the value of integrating these benefits into their core offerings, giving employees more well-rounded coverage that meets their unique needs.

But with more choices comes a new challenge: ensuring employees understand their options and can make informed decisions about what’s right for them.

And that’s where ALEX comes in.

ALEX connects employees with the right voluntary and supplemental benefits.

ALEX has long helped employees make sense of complex benefits, guiding them beyond the basics of medical, dental, and vision insurance. For years, ALEX has provided clear, personalized recommendations for Life, AD&D, Accident, and Critical Illness insurance, ensuring employees enroll in coverage that truly supports them.

Now, ALEX is expanding even further—helping employees navigate additional voluntary and supplemental benefits like hospital indemnity, pet insurance, cancer insurance, and long-term care coverage. With tailored recommendations based on individual needs, ALEX ensures that employees understand what’s available, how it works, and why it matters.

Let’s take a look at some of the latest voluntary and supplemental benefits available in ALEX:

Hospital Indemnity

Critical illness, accident and hospital indemnity insurance have been a mainstay when it comes to supplemental health plans:

And that’s a good thing, because an unexpected hospital stay can be financially devastating to employees. Three days in the hospital costs an average of $30,000 in medical bills, which most employees can’t afford out-of-pocket.

So ALEX helps you identify folks who are most likely to benefit from hospital indemnity insurance—like employees who have high health risks, are likely to become pregnant, or have pre-existing conditions. The platform helps those employees understand what hospital indemnity insurance is, how it might help them, and how much their annual costs will be.

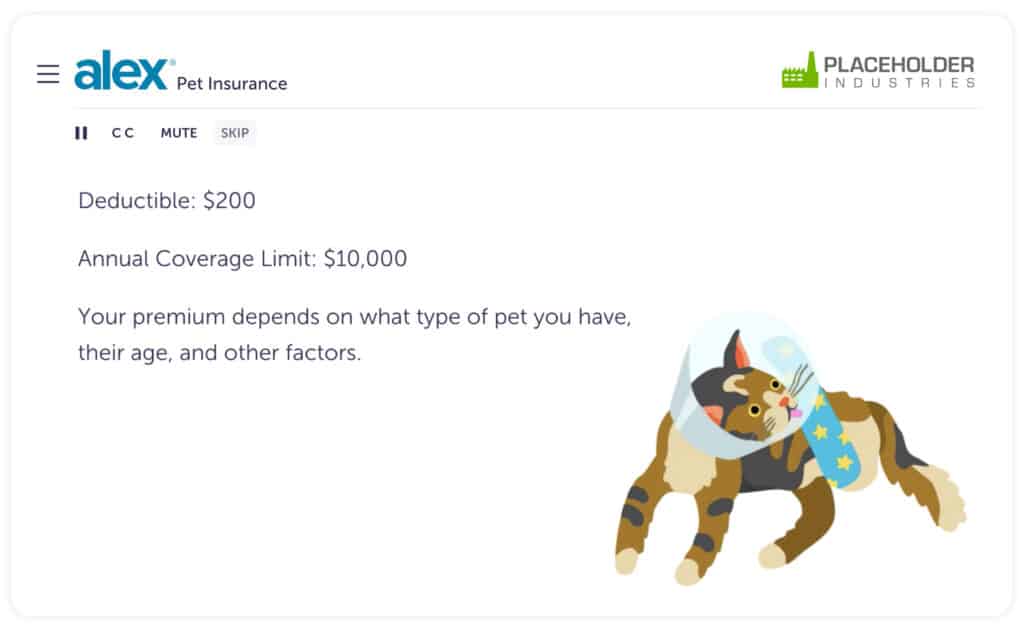

Pet Insurance

A decade ago, pet insurance might have felt like a fluffy benefit that was mostly used as a recruiting tactic. But today, it’s become a valuable resource for employees, many of whom are opting for pets instead of children, or added a pet to their family during the pandemic.

And if you have a pet yourself, you’ll know how expensive it can be: Americans spend a collective $300 billion on their pets and related expenses each year.

So now, ALEX will ask users if they have any furry friends at home, showing them how they might be able to save money on veterinary bills, daycare, and other expenses this year if they invest in pet insurance.

Cancer Insurance

Unfortunately, cancer rates are on the rise—with 2 million new cases reported in 2024 alone. That’s a new record high. And if a cancer diagnosis wasn’t stressful enough, managing the cost of treatment can be a significant barrier for many employees.

So, a surprise diagnosis can be incredibly difficult for employees to manage, especially because their traditional medical plan likely won’t be enough to fully cover their treatment.

That’s why we’re updating ALEX to help you identify and properly insure the folks who could most benefit from cancer insurance. A dedicated module will guide employees through your plan details and show them how much they should expect to pay for cancer treatment with—and without—the proper insurance.

Not only will it help millions of employees better manage their diagnosis and finances, but it could also help reduce your claims costs. It’s a win-win!

Permanent Life & Long-term Care Insurance

Have you noticed folks pushing off retirement at your own office? Aging employees are staying at work longer—both because life expectancy is higher than it used to be, and because many Americans don’t have enough saved up to retire.

And those employees are wondering how their employer-sponsored benefits pair with things like Medicare, permanent life insurance and long-term elder care. And as they look to the future, they’re worried about how they’re going to pay for it all:

Many Americans aren’t able to afford those costs on their own. So now, ALEX will address the problem head-on, well before employees retire—with dedicated support for this benefit that explains what permanent life and long-term care insurance covers.

And how it might help employees save money and access the healthcare they need towards the end of their life.

ALEX has long been a trusted guide for employees navigating voluntary and supplemental benefits like Life, AD&D, Accident, and Critical Illness insurance. Now, with an expanded offering that includes hospital indemnity, pet insurance, cancer insurance, and permanent life and long-term care coverage, ALEX is making it easier than ever for employees to understand and enroll in the benefits that truly support them. As voluntary benefits become a core part of comprehensive benefits packages, employees need clear, personalized guidance to make informed choices. ALEX continues to evolve to meet this need, ensuring every employee has the right coverage—when they need it most.