It’s no secret. This year has been tough on everyone’s wallet—employees and employers alike. Nearly 1 in 2 employees are currently worried about their financial situation, and a recent global survey of CEOs show that their economic outlook is the lowest it’s been since the Great Recession.

Your employees are looking for ways to save more. And when it comes to their benefits choices, you have a huge opportunity to step in as a trusted financial advisor. The best place to start? Help employees open and contribute more to their HSAs.

HSAs are hands-down the MVP of tax savings, but they aren’t used nearly enough. About one-third of employees never even open their account, and the average HSA contribution isn’t even enough to cover employees’ out-of-pocket medical expenses:

So helping your employees understand the value of their HSAs this year could have a huge impact on their personal finances—and it’ll boost your bottom line, too. Here are some HSA tips and tricks to drive adoption and higher contributions this year:

1. Show the cold, hard numbers

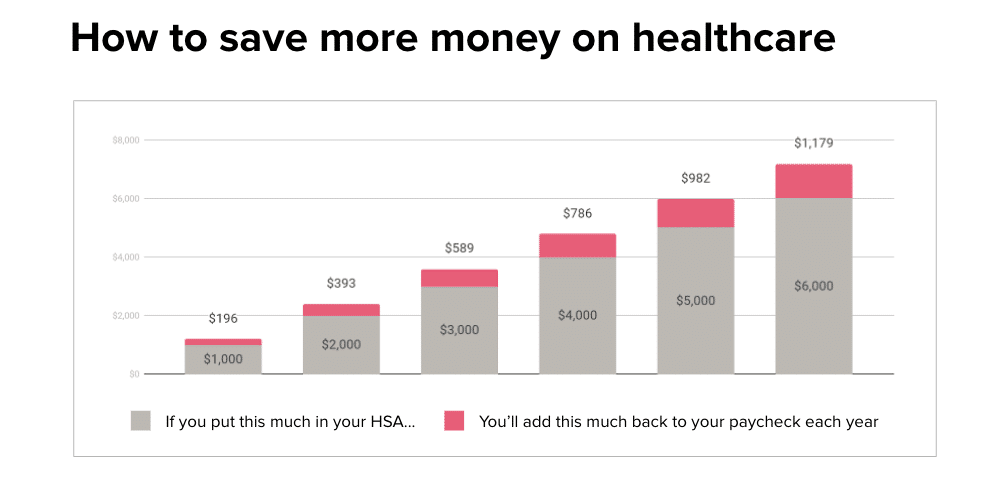

First things first. Show employees that HSA contributions are pre-tax, and break down exactly how much they could save on taxes if they invest in an HSA. Use real graphs and numbers that show: If you put $X into your HSA account, you’ll save $Y on taxes.

Use real, human language, too—that eliminates jargon and spells things out so that even non-HR folks would understand. Here’s an example:

And don’t be afraid to go negative. According to the theory of loss aversion, the pain we feel when we lose, say, $100, is twice as intense as the pleasure we feel when we win $100.

With this principle in mind, consider how you might reframe your messaging around HSAs to focus more on what employees will miss out on if they don’t act. They could either put more money in their HSAs and spend it on health care (which they’d be doing anyway), or hand it over as taxes to Uncle Sam. (Boo!)

2. Focus on per-paycheck contributions, not yearly

“How much should I contribute to my HSA per paycheck?” It’s a question you probably get a lot.

And driving higher HSA contributions is all in the positioning. Of course, you want employees to max out their HSAs so that they can fully cover their out-of-pocket expenses. But the thought of giving up $3,550 per year sounds overwhelming, and might have employees running for the hills.

Instead, frame HSA savings as a per-paycheck contribution. Explain that the average employee at their company contributes $66 per paycheck to their HSA. That’s not a huge dent, but it makes a big difference—and your employees will save hundreds per year on taxes.

That little change in messaging can go a long way in showing employees just how little they’ll be impacted each month if they choose to save the average amount in their HSAs.

3. Remind employees that HSAs are a great way to save for retirement

In response to COVID-19’s impact on the economy, 4 in 10 employees are now saving less for retirement.

So during open enrollment this year, you’ll need to drive home why it’s so important to keep saving if they can. And using an HSA as an extra retirement fund (in addition to their 401(K)) is a great way to double their investment.

While HSAs are a great way to cover medical expenses, they can also be invested like a retirement savings account, and grow year after year. And once you turn 65, your HSA savings can be spent on non-medical expenses (so you can finally buy those senior-discount skydiving lessons). Plus, if employees do end up needing to use their HSA dollars for medical expenses, they won’t be penalized for using those funds early like they would with a 401(K).

Make sure employees understand how saving now can put more money in their pockets down the road. Do the math for them, and show them: “If you add $5,000 to your HSA now, you’ll earn $500 in interest down the road.”

4. Tell real employee stories

According to the book Made to Stick by Chip and Dan Heath, communication is more memorable and motivating when you include personal stories along with the data.

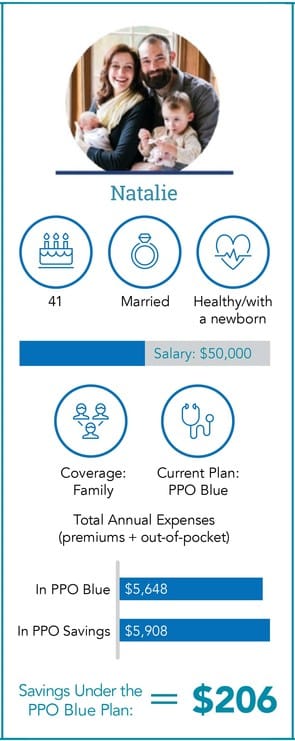

Create and share a few employee personas that illustrate why investing in an HSA is a good idea. Using real team members from your company is ideal—a recognizable face and name always helps to drive your message home.

But even if you don’t have employees who are willing to share their story, made up ones will do. You could tell the story of Dane, a healthy, single dude who uses his HSA to pay doctor’s bills AND save for retirement. Or Hannah, a mother of three who maxed out her HSA and saved $900 in taxes, which she used to save for her children’s college tuition. And so on.

(Check out these persona infographics that Penn State’s HR team made…you could easily recreate them to talk about HSAs!)

5. Invest in a benefits guidance tool

Charts, graphs and personal stories can go a long way in reminding employees why HSAs are so important. But a benefits guidance tool is the most effective way to show employees how much they could personally save on taxes and medical costs—at scale.

In fact, employees who use our benefits savings and guidance tool, ALEX, put 36% more into their HSAs than the national average. By breaking down HSAs in personalized, human language, employees say they have a better understanding of how they could benefit: