Amidst a global pandemic, employees are taking their health more seriously than ever before, and they’re concerned about their finances, too. But even though 60% of employees are paying closer attention to their benefits right now, they’re still missing opportunities to maximize their savings. Health savings accounts are one of the best ways to save on health care expenses and invest in the future, but only 11% of employees fully understand their HSAs.

As part of an HR team, you have the power to educate your employees on the benefits of funding their HSAs. But if you just hand them benefits materials filled with boring, hard-to-understand jargon, they’ll run for the hills (and end up paying far too much in taxes and out-of-pocket expenses).

If there was ever a time to clear up the confusion surrounding HSA meaning, that time is now. Let’s start off 2021 by empowering employees to take control of their healthcare spending. Here are some snooze-proof health savings account definitions you can share along with your benefit materials.

What is an HSA, and how does it work?

You’ve probably heard this question a thousand times: what is an HSA account and how does it work? (And what does HSA stand for, anyway?)

Here’s an easy health savings account definition for your benefits materials:

HSA stands for “health savings account.” It’s a personal savings account that you can use to pay for health care expenses. They’re a tax-advantaged secret weapon, and your ticket to taking control of health care spending.

Why use an HSA instead of paying out-of-pocket?

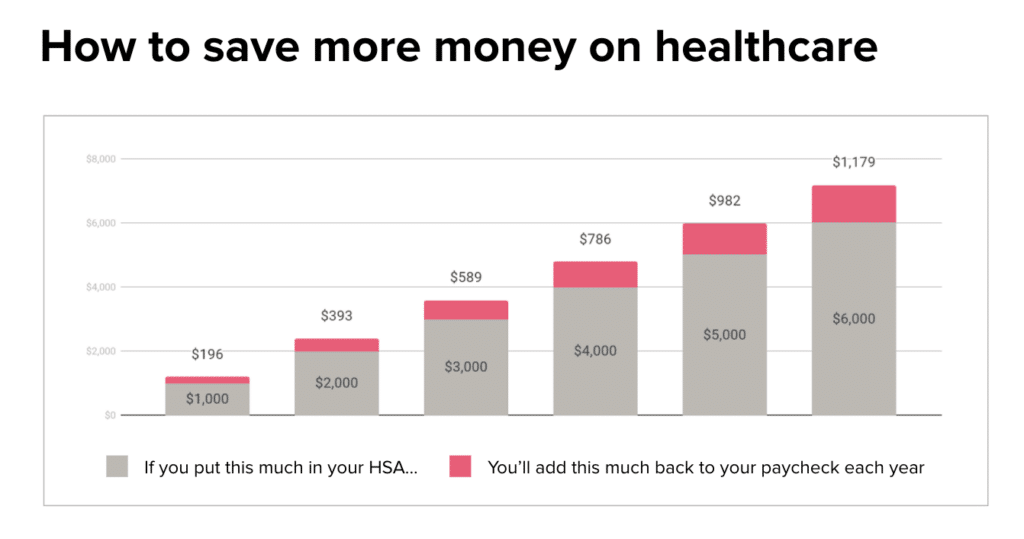

- Any money you add to your HSA is tax-deductible, which means you could put hundreds or thousands back in your paycheck each year.

- HSAs are a great partner to a high-deductible health plan (HDHP). HDHPs are great for young, healthy employees who want to pay a low premium each month. But you’ll also face hefty out-of-pocket expenses before you hit your deductible. That’s where an HSA comes in: to help you meet your deductible without having to pay taxes.

What can you use an HSA for?

HSA funds are versatile and can be used to cover a variety of out-of-pocket healthcare expenses.

Money in HSAs can be withdrawn to pay deductibles, copays, coinsurance, and vision + dental care. Depending on your benefits plan, HSAs may also cover other out-of-pocket health care expenses like:

- first aid and health monitoring supplies

- drug addiction treatment

- feminine hygiene products

- vision supplies

- fertility and maternity services

- Chiropractic services and massage

HSA funds can even be used for your spouse’s or dependents’ medical expenses, even if they aren’t on your health insurance plan.

It is important to remember that employees can be penalized for spending HSA funds on non-qualifying services. Here’s a full list of HSA-eligible expenses.

Can HSAs be used for non-medical expenses?

While HSAs are a great way to cover medical expenses, they can also be invested like a retirement savings account, and grow year after year. And once you turn 65, your HSA savings can be spent on non-medical expenses (so you can finally buy those senior-discount skydiving lessons). Plus, if your employees do end up needing to use your HSA dollars for medical expenses, they won’t be penalized for using those funds early like they would with a 401(K).

Make sure employees understand how saving now can put more money in their pockets down the road. Do the math for them, and show them: “If you add $5,000 to your HSA now, you’ll earn $500 in interest down the road.”

How much can you contribute to your HSA?

At this point, your employees are probably wondering: how much can I save in my HSA? It’s time to chat about contribution limits. Contribution limits are the maximum amount of money employees can add to their HSA per year.

2021 contribution limits:

Employees over the age of 55 can make an additional contribution of $1,000 (also called a catch-up contribution). If an employee and their spouse are above the age of 55, they can both take advantage of the catch-up contribution as long as they each have their own HSA.

You should let employees know HSAs are individually owned rather than jointly owned. An employee with family coverage can add up to the contribution limit plus their additional contribution to the HSA in the employee’s name. Their spouse can add their additional contribution to a separate HSA opened in their own name.

Do HSAs rollover?

Short answer: yes! One of the biggest differences between FSA and HSA rollover rules is that with an HSA, savings roll over year after year. That means there’s no scramble in December to spend unnecessarily (in other words, please don’t stock up on 100 boxes of bandaids, unless you’re into that kind of thing).

What about when employees move to a new company? In most circumstances, they should be able to roll over their funds from one HSA to another, too (once per 12-month period).

Another rollover method is from IRA to HSA. This is quite literally a once-in-a-lifetime opportunity, permitted by the IRS. Employees should only do this if they’re facing enormous medical expenses, and need emergency cash to cover the costs. The transfer does not count toward the HSA contribution limit for the year. Employees can’t transfer IRA funds to a spouse/partner’s HSAs– only to HSAs in their own name. They also can’t transfer funds from their HSA to their spouse/partner’s HSA, as this is not considered a qualified medical expense.

How does HSA reimbursement work?

When employees use their HSA funds, they have two options: use their HSA debit card or document the expense and reimburse themselves later.

Using the reimbursement method not only helps employees avoid fees– it also helps them cover any health care expenses they paid out-of-pocket before their HSA had enough funds (like early in the year, for example).

Receipts aren’t required for reimbursement, but documentation is always handy in case of an IRS audit. Here are a few things your employees should keep around:

- Your Explanation of Benefits (this is a record of the cost of services covered by your medical plans)

- Records of qualified medical expenses not reimbursed by another source (not reimbursed by any insurance plan)

- Any medical expenses not used as an itemized deduction

Choosing to be reimbursed for a medical expense is called taking a distribution. Employees can do this at any time (yes, even decades later) as long as they opened their HSA before the expense occurred. Employees can even reimburse themselves for expenses when they are no longer eligible to contribute to their HSA. Once employees add money to their HSA, it is theirs to use.

Some people choose to pay for health care expenses and wait to reimburse until they reach retirement. The more time they give HSA funds to gain interest, the more they will grow. This can be a great way to get more money for retirement. Of course, this means detailed record keeping. If they are audited and don’t have receipts and invoices, they will have to pay income tax plus a 20% penalty on the reimbursements.

When it’s time to file taxes, employees should use IRS Tax Form 8889 to report their distributions. As long as they report correctly and keep solid records, they won’t face any 20% penalties and can enjoy the tax-free benefits.

What’s the difference between an HSA vs. FSA?

There are a few key similarities and differences you should make sure your employees understand when having the HSA vs. FSA discussion. First, employees should note that both HSAs and FSAs have tax benefits and contribution limits.

Now, onto the harder part. Here are a few of the main differences between HSAs and FSAs:

| HSAs | FSAs |

|---|---|

| Best paired with an HDHP | Best paired with a low deductible plan, like a PPO or HMO |

| Used like a debit card (can only spend what you’ve already saved, and reimburse yourself for out-of-pocket expenses later) | Used like a credit card (employees can spend money they haven’t saved yet, as long as they expect to save that amount by the end of the year) |

| Save over time: Funds roll over year after year without penalty | Use it or lose it: if employees have money left over at the end of the year, they have to spend it or it will be wasted |

You can’t add money to a traditional FSA and an HSA in the same year, but you can contribute to an LPFSA to help with dental and vision costs and a Dependent Care FSA to help with childcare costs in addition to an HSA.