Originally published 3/22/21, updated 1/8/24

From housing to childcare to cars, the effects of inflation are hitting Americans hard. And in our own world of benefits, rising healthcare costs are impacting employees and employers alike.

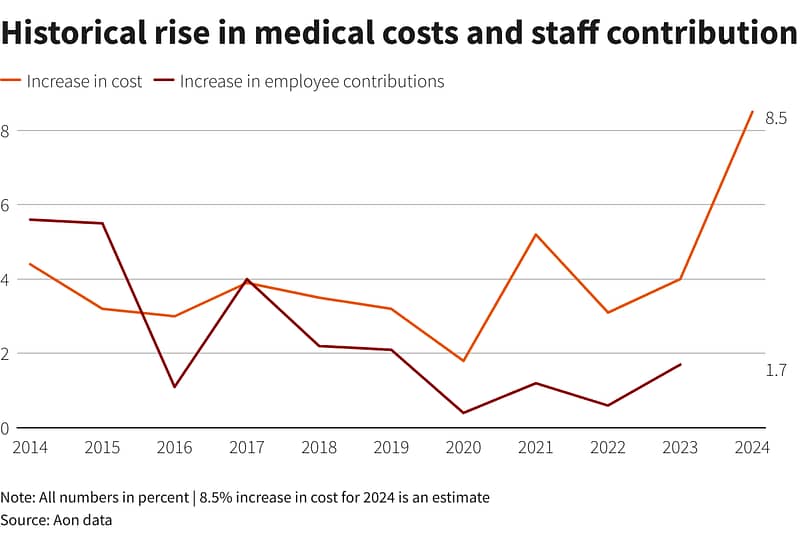

In fact, we’re bracing for the biggest leap in a decade, with experts predicting a 5.4% to 8.5% increase in costs for 2024. So why are healthcare costs rising, and what can employers do to prevent overspending?

Let’s look at what’s changed in the past ten years, and explore why we’re facing a make-or-break moment to control excessive healthcare spending.

How much do we currently spend on healthcare?

For any organization in any given year, employee benefits are a significant slice of the pie.

You’ve likely seen the stats. Employers spend more than 30% of their overall budget on compensation and benefits, investing about $21,500 per employee. So at a 1,000-employee company? That’s $21.5 million per year. Yikes.

There’s a big price tag for employees, too. The average annual health insurance premium in 2023 was $8,435 for single coverage and $23,968 for family coverage.

How will rising healthcare costs impact employers and employees this year?

Employers, we hate to break it to you…but you’re stuck between a rock and a hard place. You’re likely worried about your bottom line in 2024, but you’re also competing harder than ever for top talent, and are looking for ways to retain employees.

That means you’ll need to figure out a way to combat rising healthcare costs without taking valuable resources away from your workforce. Employers around the country are working hard to not burden their employees, and are absorbing most healthcare costs themselves.

Mercer found that over two-thirds of employers either do not plan to shift any cost increase to their staff, or will pass on less than the expected rise in 2024.

In other words, your organization is taking almost full responsibility for any cost increases in 2024. The key to minimizing the impact? Understanding the biggest causes for rising healthcare costs, so that you can properly guide employees towards cost-effective solutions. Let’s dig in.

Why are healthcare costs rising?

Medical industry consolidation

In addition to recent economic turmoil, one of the major reasons for rising costs of healthcare is medical industry consolidation. Healthcare mergers and acquisitions were on the rise in 2023, bringing together health systems that provide different services or operate in different geographic locations.

Experts argue that these mergers could negatively impact costs, while doing little to improve quality of care.

Weight loss drugs

If there was one healthcare buzzword in 2023, it was “Ozempic.” Trendy new weight loss drugs aren’t just in demand for diabetes patients—they’re also popular with the general population.

And these highly sought-after drugs have a major effect on the healthcare economy. Of its projected 8.5% increase in employer healthcare costs for next year, Aon anticipates that weight loss drugs alone will contribute 1 percentage point.

Wegovy, an approved obesity treatment, is soaring in U.S. sales. In Q2 alone, the popular drug made over $1 billion last year.

That means employers must diligently educate their employees about their options when it comes to weight loss, and direct them towards the most cost-efficient options.

Newly released gene therapies

Over the past year, the United States approved several new gene therapies. From sickle cell disease to hemophilia, these milestone treatments will pave the way for more effective medical care.

But they also come with a massive price tag. Reuters reports that most new gene therapies cost over $1 million, and employers are feeling the impact. Consultants claim that gene therapy treatment of just one employee could significantly raise costs for a company.

Behavioral health conditions

Behavioral health conditions have skyrocketed in the last few years. Some estimates suggest that 35 million people developed a new behavioral health condition during the pandemic. This alone could lead to higher healthcare costs, but there’s also the idea that those with behavioral health diagnoses have around four times the average healthcare spending of those that don’t. It’s a domino effect that also has no clear end in sight.

Ways to control the rising cost of healthcare

Employers can’t control everything, and they’re not going to solve systemic infrastructure problems overnight. But what they can do is start to help employees change their behavior.

Here’s how to control rising healthcare costs at your organization this year:

1. Build a foundation of trust through comprehensive benefits.

When costs go up, it can be tempting to cut back on your total rewards package. But eliminating important resources could be expensive too: employee benefits are one of the biggest retention tools in your belt.

So show your workforce that you’re still invested in their well-being by maintaining the status quo as much as you can. Give them a reason to trust you by providing the best possible care at the best possible cost. And look for ways to absorb the bulk of any healthcare cost increases this year, so that employees won’t have to shoulder them.

2. Identify high-risk employees

As we discovered in the previous section, high-risk employees are responsible for some of this year’s biggest healthcare cost increases.

New treatments for obesity, cancer, and genetic diseases are providing patients with better care than ever before. But they also might come with some sticker shock for employees and employers alike.

It’s a problem we’re especially passionate about here at Jellyvision. That’s why we’re building our benefits engagement platform, ALEX, to leverage claims data and other health metrics. ALEX will analyze employees’ actual healthcare use to help them find ways to save money without compromising coverage.

3. Leverage new technology.

One way to cut back on heavy administrative costs? New technology.

HR teams can’t be everywhere, giving personalized healthcare advice that will save money for every employee. That’s where tools like predictive analytics and behavioral science come in handy, helping employees anticipate upcoming expenses and expertly guiding them towards behavior changes that will help them save.

Learn how predictive analytics can reduce healthcare costs.

4. Frame the math, and the tradeoffs.

Focus on cost transparency for each employee. Detail all of the costs an employee might incur when choosing a specific plan or making a healthcare decision.

It’s not just the math around the plan design. Employees need to understand how a plan might affect their cashflow, for example, if they need hospitalization or an unexpected x-ray or MRI. They need to understand which doctors are in-network, and what happens if they see someone outside that network. They need to understand how their health savings account can help them save for now and for the future.

Help them evaluate each plan’s impact on them personally given their unique health and financial status. (ALEX can help!)

5. Encourage employees to seek preventive care.

Encouraging employees to prioritize preventative healthcare is crucial for employers in fostering a healthy and productive workforce. Proactive healthcare measures not only contribute to individual well-being but also have a profound impact on overall workplace dynamics. When employees are encouraged to seek regular check-ups, vaccinations, and wellness programs, they’re more likely to stay healthy and catch potential issues early on. This can result in fewer sick days, increased productivity, and improved morale.

In addition, a workforce that prioritizes preventative healthcare can lead to lower healthcare costs for employers in the long run. Addressing health concerns in their early stages is often more cost-effective than dealing with advanced, potentially chronic conditions. By emphasizing and supporting preventative healthcare initiatives, employers not only invest in the health and happiness of their employees but also create a positive and thriving work environment.

Conclusion

The reasons behind the rising costs of healthcare are complex and multifaceted. But employers have a pivotal role in navigating this challenging landscape by implementing proactive strategies that will contain expenses and improve the overall health and well-being of their workforce.

By investing in wellness initiatives, leveraging technology, and advocating for value-based care, employers can contribute to a more sustainable healthcare system. Collaboration between employers, policymakers, and healthcare stakeholders is essential to drive systemic changes that address the root causes of rising healthcare costs and ensure a healthier, more cost-effective future for all.