This blog post is based on The Broker’s Path to a Successful COVID-19 Open Enrollment, a three-part webinar. Watch the full series here.

Since COVID-19 hit in March, your world’s turned upside down. At home, you might be balancing work with suddenly becoming a kindergarten teacher, or spending more time than usual with a spouse or roommate.

And as a benefits consultant, things have probably changed too. According to a recent McKinsey report, brokers’ in-person meetings with clients dropped from 70% in January to less than 5% in May. Suddenly your face-to-face visits have turned into Zoom calls, and you’re probably scrambling to help your clients support their employees and offer the right resources during COVID-19.

But before you start solving problems for your clients, it’s useful to get really sharp about what those problems actually are, and learn what your clients and their employees need the most. Let’s dive into exactly how COVID-19 has affected employers and their team members, and how you can help:

COVID-19’s Effect on Employers

We know the economy isn’t doing us any favors right now. Unemployment saw one of the most dramatic spikes in history this spring, and a recent survey of global CEOs showed that their economic outlook is the lowest it’s been since the 2009 recession.

And here at Jellyvision, we’ve been tracking COVID-19’s impact within our own customer base too — to see how the employers we work with have mirrored national trends, and find out what specific hardships they’re facing. Here’s what we found:

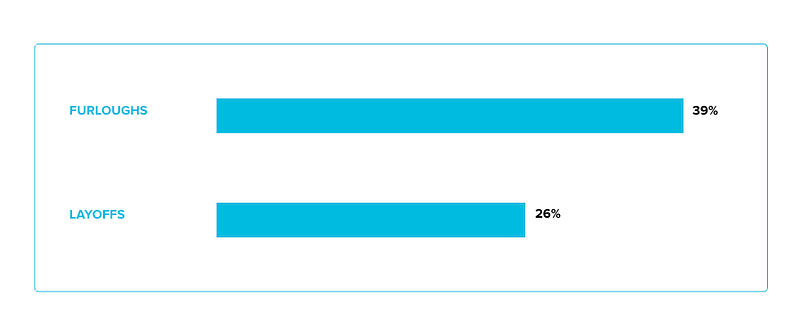

65% of employers reported furloughs or layoffs

Unfortunately, 65% of the difficult events our customers told us about impacted people’s employment and paycheck.

It’s probably no surprise based on what you’re hearing in the news right now, but furloughs and layoffs were really prevalent this year, as employers were forced to look at drastic cost-cutting measures while revenue numbers really took a hit.

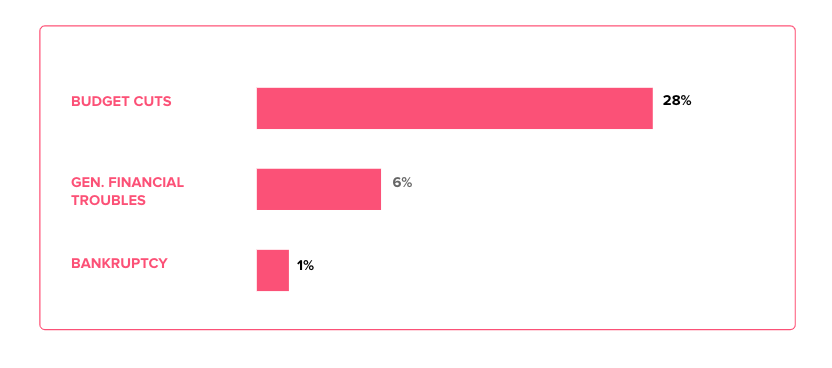

35% are under significant financial strain

And beyond the impact to employees’ paychecks, our customers are also feeling a lot of financial strain — mostly materializing as budget cuts, but some even facing bankruptcy.

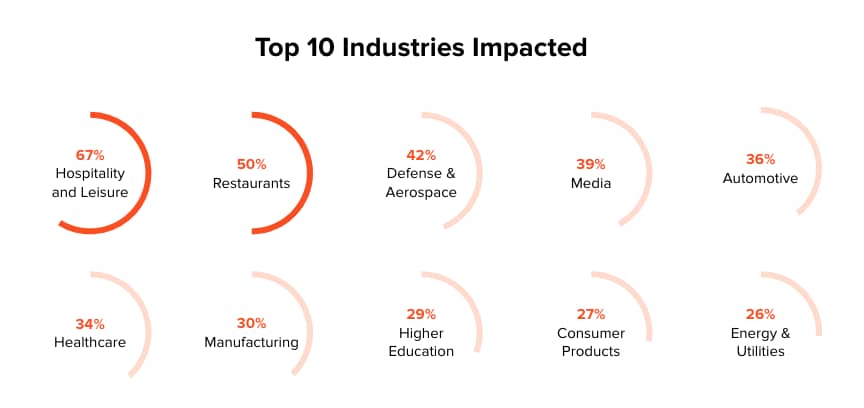

Hospitality and restaurant businesses have been hit particularly hard

Looking at impact across industries, this current moment is tough for companies across the board, but some industries were hit harder than others.

Our customers line up with the national trends in many ways—hospitality and restaurant businesses said they were being hit particularly hard, along with manufacturing and automotive companies. But really, almost no industry was exempt from the impact of COVID.

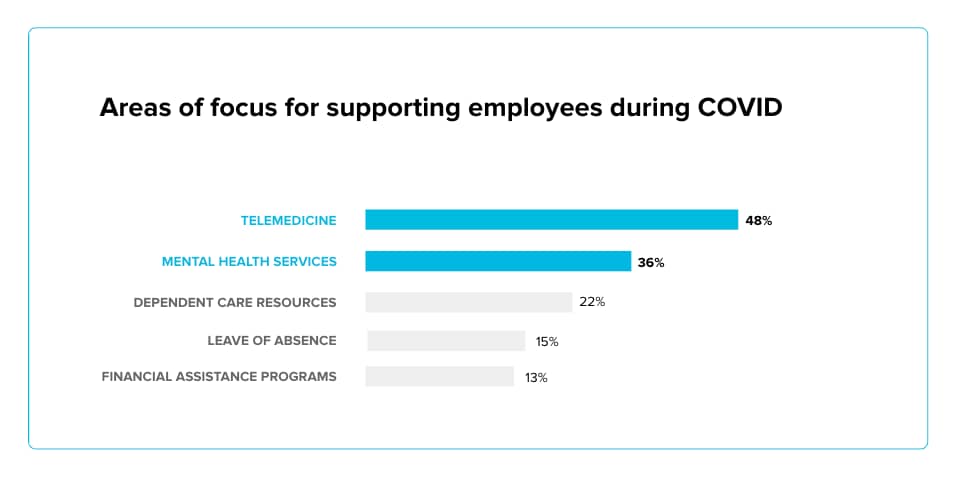

Employers are adjusting their benefits focus

There is some good news. Most employers have been quick to shift their focus on the benefits that can support employees most during this particularly difficult time.

As you’ve likely seen with your own clients, our customers shifted their communications to focus on things like telemedicine, so that employees can continue to get the healthcare they need without having to go to a doctor’s office in person.

Employers were also keenly aware of the heightened stress and anxiety of the current moment, so they’re increasing their focus and expanding their role on mental health.

COVID-19’s Effect on Employees

It’s great that your clients are already looking for ways to support their employees, but there’s still a lot of room for concern. Employees are just as stressed as you and your clients are, and there’s a huge opportunity to offer them more support.

They’re concerned about their personal finances

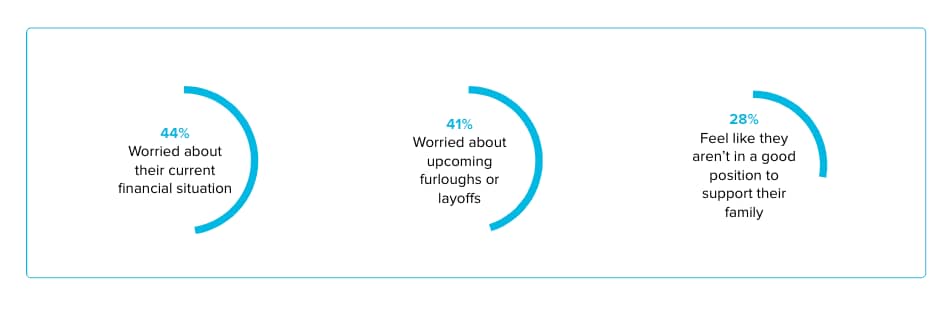

We recently conducted a survey of 1,000 employees to find out how they’re feeling in light of COVID-19, and almost half are worried about their current financial situation. With the state of the economy, they’re also worried about upcoming furloughs and layoffs, and almost one-third feel like they aren’t in a good financial position to support their family.

They have an increasingly negative impression of their employers

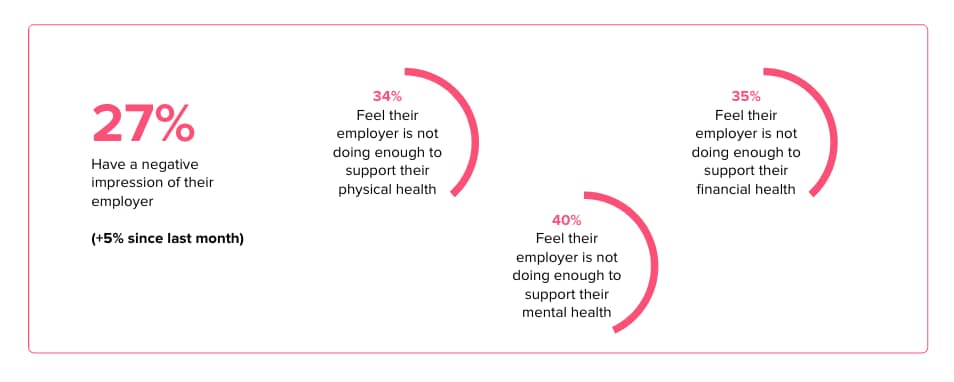

27% of employees say they have a negative impression of their employer. That might seem like a small percentage, but that number has gone up over time — just in the last month, it’s increased 5%.

And at least a third of employees feel their employers aren’t doing enough to support their physical, mental and financial health. Those numbers have risen over time, too.

So while the stats show that employees are generally satisfied, there’s a decent-sized, growing minority that’s not happy. And that trend shouldn’t be ignored when you’re working on plan designs or communications plans with your clients. This is the year to go above and beyond to show employees how much you and your clients are there to support them.

And they’re changing how they manage their benefits

There’s a silver lining to all of the bad news. In a normal year, 93% of employees default to the same old plans they enroll in every year.

But this year, they’re much more likely to take a fresh look. In fact, 59% of employees told us they’ll be paying more attention to their benefits this year.

Of all the data we’ve shared, this one offers the most hope. In the midst of all the COVID-19 chaos, employees actually care what you have to say during open enrollment—and for the first time, they’ll be listening when you encourage them to try a different plan, or save a little bit more in their HSAs. So it’s up to you and your clients to capitalize on that opportunity.

What this means for you

This is hands-down your year. It might sound counterintuitive with the year we’re having, but there’s a golden opportunity at your fingertips to have your best open enrollment season ever.

Because employees are paying more attention this year, you have a huge opportunity to change their behavior. So it’ll be all about finding better ways to communicate your clients’ benefits packages and make them more relevant to employees.

If you can offer the right messaging and explain benefits in a clear, human way, you might actually be able to drive employees to make smarter benefits decisions, and not just auto-enroll in the same old plans they pick every year. That could help the employee save money AND boost your clients’ bottom line, in an especially critical year.