Originally published 4/10/23, updated 10/2/23.

The workforce is older than ever. And in the U.S., a main concern for aging employees is how to access and pay for healthcare.

Fortunately, Medicare has made it easier for folks who are 65 years or older to get government-sponsored coverage. And while Medicare offers a range of benefits, from medical and hospital stay insurance to skilled nursing and more, there’s a pesky coverage gap known as the “donut hole.” It can affect prescription drug coverage for some Medicare users, forcing them to shell out more money once they reach a certain threshold.

But what is the donut hole in Medicare, and what does it mean for aging employees? Here’s how to explain it in your benefits materials.

What is the “donut hole” in Medicare?

No, it’s not a treat you can pick up from Dunkin’. 🍩 (We wish.)

The “donut hole,” also known as the coverage gap, is a temporary limit on how much Medicare will pay in prescription drug coverage under Part D.

REFRESHER: WHAT IS MEDICARE PART D?

ALEX Medicare gets to know employees through a one-on-one conversation and helps them navigate the intricacies of Medicare (without burdening your team). Available via ALEX Benefits Counselor or ALEX Go, aging employees can access guidance wherever they are, on whatever device they’re most comfortable using.

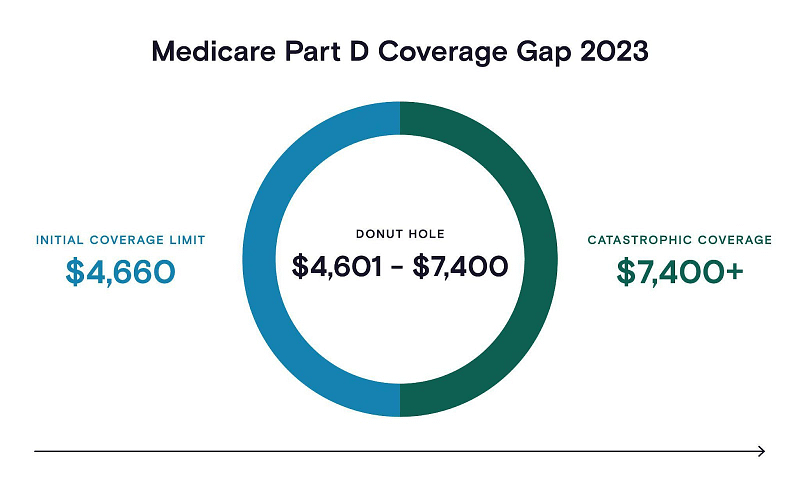

The donut hole happens when a Medicare user has reached their initial coverage limit but before they have spent enough on their prescriptions to reach what’s called a “catastrophic coverage threshold.”

In 2023, the initial coverage limit is $4,660. Once a Medicare user has spent that amount on covered drugs, they enter the donut hole, where they’re responsible for a larger portion of their prescription drug costs. During this period, users will be responsible for up to 25% of the cost of their brand-name and generic drugs.

The donut hole ends when a user has spent a total of $7,400 out-of-pocket on prescription drugs for the year. After reaching this threshold, they enter the catastrophic coverage phase, where they pay only a small copayment or coinsurance amount for their prescription drugs for the remainder of the year.

How does the donut hole affect Medicare users?

The donut hole can be a significant burden for some beneficiaries, especially those who take expensive prescription drugs or have chronic conditions that require ongoing medication. Once they’re in the coverage gap, Medicare users must pay a larger share of their drug costs, which can be financially challenging, especially for those entering retirement or on fixed incomes.

The donut hole can also be confusing for users who are not familiar with Medicare’s prescription drug coverage rules. Many beneficiaries may not realize that they have entered the coverage gap, and may be caught off guard by the sudden increase in their out-of-pocket costs. So as their benefits advisor, it’s your job to help users anticipate upcoming costs and better understand what each phase of Medicare Plan D looks like financially.

Pro Tip: ALEX can help!

ALEX Medicare gets to know employees through a one-on-one conversation and helps them navigate the intricacies of Medicare (without burdening your team). Available via ALEX Benefits Counselor or ALEX Go, aging employees can access guidance wherever they are, on whatever device they’re most comfortable using.

How to avoid the donut hole

As users age and their prescription usage increases, avoiding the Medicare donut hole might feel like approaching the Everything Bagel in Everything, Everywhere, All at Once.

And while for many beneficiaries, it’s not possible to completely avoid the coverage gap, it doesn’t have to feel like heading towards a black hole. There are steps that Medicare users can take to reduce their out-of-pocket costs and potentially delay entering the coverage gap.

Here are some strategies to consider:

Compare Part D plans

Each year, Medicare users can review and change their Part D plan during the Annual Enrollment Period (AEP). By comparing plans, beneficiaries may be able to find one that better meets their prescription drug needs and helps them avoid the donut hole.

Use generic drugs

Generic drugs are often less expensive than their brand-name counterparts, and using them can help Medicare users stay below the initial coverage limit.

Take advantage of discounts

Some pharmaceutical manufacturers offer discounts on their brand-name drugs to Medicare users who are in the donut hole. These discounts can help lower out-of-pocket costs and delay reaching the catastrophic coverage threshold.

Apply for Extra Help

Low-income Medicare users may be eligible for the Extra Help program, which provides assistance with prescription drug costs. This program can help beneficiaries avoid the donut hole and reduce their out-of-pocket costs.

Better-informed (and happier) Medicare users

While the Medicare donut hole can be challenging to navigate, there are steps that beneficiaries can take to reduce their out-of-pocket costs and potentially delay entering the coverage gap.

And as more and more employees enroll in Medicare while still working full-time, it’s now up to us—their trusted advisors—to help them better understand Medicare costs and take advantage of cost-saving strategies and resources. But deciphering the complex world of Medicare can also be a huge challenge for us as benefits pros. So if you’re feeling overwhelmed about how to guide Medicare users through the maze, Jellyvision is here to help.