Workers in the United States set a record in April 2021 with nearly 4 million resignations, and the number of workers quitting in July almost topped that number. The so-called Great Resignation is alive and well, and it’s making it harder than ever for companies to attract talent for any range of jobs, from entry level to executive.

The past two years have given employees a whole slew of reasons to quit their jobs. The massive lifestyle changes caused by COVID have driven workers to re-evaluate their career goals, and heightened awareness about workplace rights are causing people to demand higher salaries and more flexible schedules. While some factors are out of our hands, there’s a lot we can do as HR pros to address these massive changes in workplace expectations. Companies are looking for ways to increase employee engagement, build better culture, support those working remotely, and boost compensation.

One solution that companies may have overlooked? Employee benefits packages. In fact, a recent Jellyvision survey revealed that a better employee benefits package is the #2 reason why employees would consider jumping ship:

Top factors that would motivate employees to leave their current job for a new one

- Higher pay

- Better employee benefits package

- Ability to work remote

Source: Jellyvision survey, November 2021

From benefits basics such as health insurance and retirement planning to inclusive benefits that support an increasingly diverse workforce, benefits are an easy yet important way for a company to show its employees that they are valued. Here’s a look at how your organization can make the most of its employee benefits package to help retain talent at a time when so many workers are exploring their options.

Remember, it starts at onboarding

Employee benefits are a critical selling point for recruitment, and an important focus as we prepare for the next big hiring trend: The Great Onboarding. According to our latest survey, 85% of employees say the benefits package is an important factor in accepting a job offer. This makes perfect sense, especially in a job market like today’s – if applicants have multiple offers to choose from, the company with the best benefits is likely to stand above the rest.

Unfortunately, many companies struggle to carry over the best of their benefits from recruitment to onboarding. According to our recent onboarding statistics report:

Clearly, onboarding is a missed opportunity to educate new employees about their benefits. Sharing benefits information in advance is a no-brainer – especially if your company is practicing good virtual onboarding habits and sending workers their computer (plus a little swag) before their first day. Pair that with a short one-on-one benefits session during onboarding and your employees will be ready to make informed, confident benefits decisions.

Guide employees throughout the year

Obviously, onboarding is only the beginning of any job. Employees continuously receive on-the-job training, meet with their managers regularly to discuss performance goals and expectations, and receive feedback from peers and leadership alike.

The same should be true of benefits guidance. We say “should be” because for most companies, it isn’t. For example:

- 51% of employees only view their benefits portal 1-3 times per year

- 40% of employees don’t understand the information they receive about benefits

- One-third of employees have never taken action on any benefits communication that they’ve received.

The key to fixing this is to make sure employees know that you’re there for guidance and support throughout the year. This requires a year-round employee benefits communication plan.

Many companies take a calendar-based approach, but that angle can miss the mark. If employees have trouble understanding benefits communication and don’t take action on it, then they unfortunately aren’t going to appreciate your creative messaging on National 401(k) Day or National Walk to Work Day as much as you will.

The more effective plan is an action-based approach. This emphasizes providing guidance to employees in the moments that matter – when they need to use their benefits or are otherwise engaged. When an employee takes action such as logging into their health savings account, buying a prescription, filing a medical claim, or searching for a doctor, that’s the time to provide messaging about how they can get the most out of their benefits.

Guiding employees in the moments when they’re using their benefits does two things. It reminds employees of how their benefits are working for them. It also helps both the employee and the company save time and money. That’s a clear win-win.

Prioritize mental health resources

At the height of COVID-19 last year, a McKinsey survey found that mental health was having a negative impact on productivity for 87% of companies. As a result, 32% of companies said they were making “significant” investments in mental health resources, and are making mental health a top priority for their HR department. Another 39% of companies were making “some” investment in mental health interventions.

These investments are certainly welcome, as the pandemic has taken its toll on everyone. Increasingly, they are expected; a survey from medication app Calm found that 76% of workers consider mental health benefits a key factor in evaluating new jobs.

However, it’s one thing to simply add mental health resources to your catalog of covered benefits. Companies need to walk the walk and show that mental health is a priority. Right now, they’re not.

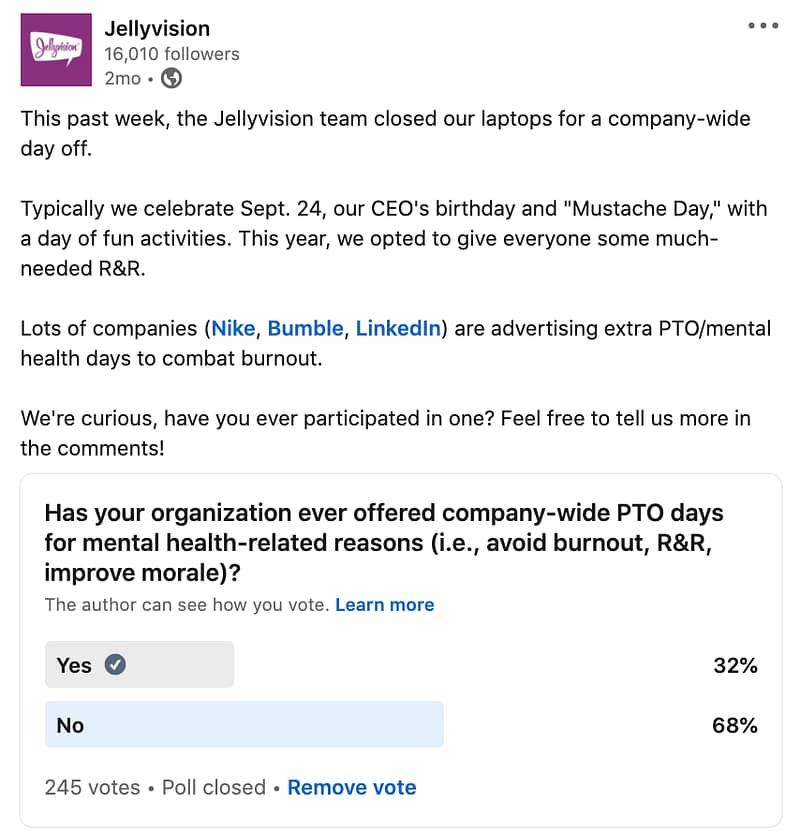

In a recent survey of HR leaders and employees, we found that 1 in 3 employees don’t believe their employers encourage them to seek mental health care. And when we asked on social media, two in three respondents said they did not receive any company-wide PTO days as a way to avoid burnout, improve morale, or simply relax.

This could have long-lasting implications. A recent Forrester survey showed that 1 in 3 employees are thinking of changing their job to preserve their mental health. According to Harvard Business Review, employee burnout rates seem to be highest in industries that saw “extreme increases” in demand during the pandemic, such as health care and technology. As employees leave, companies pay a steep price to replace them.

HR pros: How are you incentivizing employees to join (and stay) at your company during the Great Resignation?

A few of our community members answered:

“We incentivized employees to stay at our company by offering better mental health benefits.”

“A solid starting bonus and extra time off are new incentives at our company during these challenging times.”

“Better health benefits and incentives.”

“We are offering more flexible work schedules.”

“We are offering the hybrid option for workday structure (partially at home, partially at facilities). We are also offering a higher portion of employer paid-medical benefits.”

Companies need to combat burnout – and prevent employees from leaving – by giving them the resources and the space to care for their mental health. Both are essential. Workers need to know that they can use mental health services, take a mental health day, or speak to management without fear of repercussion. They also need access to services where and when they need them. On-site appointments, for example, may not work for remote employees or anyone working outside normal business hours.

Leadership can play a key part in advocating for mental health. If employees see executives publicly and openly discussing mental health, then they will see that the stigma associated with seeking mental health help has been removed. That will help encourage use, especially among employees who may have been reluctant before.

Make your benefits package inclusive

One of the hardest lessons we’ve all learned in the last two years is the unfortunate reality that social, racial, and gender inequality is baked into just about every institution in our country. Racial and ethnic disparities in health care are widely documented, with marginalized groups experiencing poorer health outcomes and an increased likelihood of premature death compared to white Americans. The same is true for socioeconomic status, as lower-income Americans are more likely to be diagnosed with a chronic condition, are less likely to access care, and have a lower life expectancy.

No single step will address this problem in its entirety, but companies can take an important step by providing a more inclusive benefits package that meets the needs of a diverse workforce. Not only will this give employees much-needed support at a time of need, but it will help your company stand out in an increasingly competitive job market. Here are a few examples of health care benefits to consider:

- Extension of health care benefits to unmarried domestic partners.

- Paid parental leave, including leave for those who adopt a child or serve as foster parents, as well as leave for fathers.

- Fertility benefits, including coverage for single people and those in same-sex partnerships.

- Coverage of gender affirmation treatment, including mental health support.

- Telehealth as a low- or no-cost alternative to in-person care.

A range of additional inclusive benefit offerings can also help employers serve the needs of employees who have traditionally felt marginalized or otherwise left behind at work. These can include but of course are not limited to:

- Childcare reimbursement and/or onsite childcare options.

- Student loan payment assistance.

- Professional development reimbursement (in addition to college tuition assistance).

- Apprenticeship or training programs for job candidates from non-traditional backgrounds (including veterans).

- Access to low-interest loans for car or home purchases.

- Financial planning assistance (in addition to retirement and/or health savings accounts).

- Floating holidays for employees of varying cultural and religious backgrounds.

- Flexible scheduling (including remote work options) to accommodate the needs of working parents, older employees, and/or employees with disabilities.

- Flexible bereavement, including paid time off for non-immediate family members.

- Cafeteria or lunch subsidies that increase access to healthy food options.

Benefits basics at employees’ fingertips

You can lead a horse to water, but you can’t make it drink. The same goes for employee benefits. Your company can put together the best, most competitive benefits package on the market – but if employees can’t access it, or don’t know what’s covered, then they won’t take advantage of it. And then HR leaders will have a hard time convincing executive leadership that those benefits are worth the investment.ALEX lets employees engage with their benefits where and when they want to – not just during onboarding or open enrollment, but when they have a specific need. Employees get the information they need at their fingertips, while companies can provide educational resources and help employees make time- and money-saving decisions. With so many workers looking for a reason to leave a job, this offers companies a reason for them to stay.